WASHINGTON (AP) — Four out of 5 U.S. adults struggle with joblessness, near-poverty or reliance on welfare for at least parts of their lives, a sign of deteriorating economic security and an elusive American dream.

Survey data exclusive to The Associated Press points to an increasingly globalized U.S. economy, the widening gap between rich and poor, and the loss of good-paying manufacturing jobs as reasons for the trend.

The findings come as President Barack Obama tries to renew his administration’s emphasis on the economy, saying in recent speeches that his highest priority is to “rebuild ladders of opportunity” and reverse income inequality.

As nonwhites approach a numerical majority in the U.S., one question is how public programs to lift the disadvantaged should be best focused — on the affirmative action that historically has tried to eliminate the racial barriers seen as the major impediment to economic equality, or simply on improving socioeconomic status for all, regardless of race.

Hardship is particularly growing among whites, based on several measures. Pessimism among that racial group about their families’ economic futures has climbed to the highest point since at least 1987. In the most recent AP-GfK poll, 63 percent of whites called the economy “poor.”

“I think it’s going to get worse,” said Irene Salyers, 52, of Buchanan County, Va., a declining coal region in Appalachia. Married and divorced three times, Salyers now helps run a fruit and vegetable stand with her boyfriend but it doesn’t generate much income. They live mostly off government disability checks.

“If you do try to go apply for a job, they’re not hiring people, and they’re not paying that much to even go to work,” she said. Children, she said, have “nothing better to do than to get on drugs.”

While racial and ethnic minorities are more likely to live in poverty, race disparities in the poverty rate have narrowed substantially since the 1970s, census data show. Economic insecurity among whites also is more pervasive than is shown in the government’s poverty data, engulfing more than 76 percent of white adults by the time they turn 60, according to a new economic gauge being published next year by the Oxford University Press.

The gauge defines “economic insecurity” as a year or more of periodic joblessness, reliance on government aid such as food stamps or income below 150 percent of the poverty line. Measured across all races, the risk of economic insecurity rises to 79 percent.

Marriage rates are in decline across all races, and the number of white mother-headed households living in poverty has risen to the level of black ones.

“It’s time that America comes to understand that many of the nation’s biggest disparities, from education and life expectancy to poverty, are increasingly due to economic class position,” said William Julius Wilson, a Harvard professor who specializes in race and poverty. He noted that despite continuing economic difficulties, minorities have more optimism about the future after Obama’s election, while struggling whites do not.

“There is the real possibility that white alienation will increase if steps are not taken to highlight and address inequality on a broad front,” Wilson said.

___

Nationwide, the count of America’s poor remains stuck at a record number: 46.2 million, or 15 percent of the population, due in part to lingering high unemployment following the recession. While poverty rates for blacks and Hispanics are nearly three times higher, by absolute numbers the predominant face of the poor is white.

More than 19 million whites fall below the poverty line of $23,021 for a family of four, accounting for more than 41 percent of the nation’s destitute, nearly double the number of poor blacks.

Sometimes termed “the invisible poor” by demographers, lower-income whites generally are dispersed in suburbs as well as small rural towns, where more than 60 percent of the poor are white. Concentrated in Appalachia in the East, they are numerous in the industrial Midwest and spread across America’s heartland, from Missouri, Arkansas and Oklahoma up through the Great Plains.

Buchanan County, in southwest Virginia, is among the nation’s most destitute based on median income, with poverty hovering at 24 percent. The county is mostly white, as are 99 percent of its poor.

More than 90 percent of Buchanan County’s inhabitants are working-class whites who lack a college degree. Higher education long has been seen there as nonessential to land a job because well-paying mining and related jobs were once in plentiful supply. These days many residents get by on odd jobs and government checks.

Salyers’ daughter, Renee Adams, 28, who grew up in the region, has two children. A jobless single mother, she relies on her live-in boyfriend’s disability checks to get by. Salyers says it was tough raising her own children as it is for her daughter now, and doesn’t even try to speculate what awaits her grandchildren, ages 4 and 5.

Smoking a cigarette in front of the produce stand, Adams later expresses a wish that employers will look past her conviction a few years ago for distributing prescription painkillers, so she can get a job and have money to “buy the kids everything they need.”

“It’s pretty hard,” she said. “Once the bills are paid, we might have $10 to our name.”

___

Census figures provide an official measure of poverty, but they’re only a temporary snapshot that doesn’t capture the makeup of those who cycle in and out of poverty at different points in their lives. They may be suburbanites, for example, or the working poor or the laid off.

In 2011 that snapshot showed 12.6 percent of adults in their prime working-age years of 25-60 lived in poverty. But measured in terms of a person’s lifetime risk, a much higher number — 4 in 10 adults — falls into poverty for at least a year of their lives.

The risks of poverty also have been increasing in recent decades, particularly among people ages 35-55, coinciding with widening income inequality. For instance, people ages 35-45 had a 17 percent risk of encountering poverty during the 1969-1989 time period; that risk increased to 23 percent during the 1989-2009 period. For those ages 45-55, the risk of poverty jumped from 11.8 percent to 17.7 percent.

Higher recent rates of unemployment mean the lifetime risk of experiencing economic insecurity now runs even higher: 79 percent, or 4 in 5 adults, by the time they turn 60.

By race, nonwhites still have a higher risk of being economically insecure, at 90 percent. But compared with the official poverty rate, some of the biggest jumps under the newer measure are among whites, with more than 76 percent enduring periods of joblessness, life on welfare or near-poverty.

By 2030, based on the current trend of widening income inequality, close to 85 percent of all working-age adults in the U.S. will experience bouts of economic insecurity.

“Poverty is no longer an issue of ‘them’, it’s an issue of ‘us’,” says Mark Rank, a professor at Washington University in St. Louis who calculated the numbers. “Only when poverty is thought of as a mainstream event, rather than a fringe experience that just affects blacks and Hispanics, can we really begin to build broader support for programs that lift people in need.”

The numbers come from Rank’s analysis being published by the Oxford University Press. They are supplemented with interviews and figures provided to the AP by Tom Hirschl, a professor at Cornell University; John Iceland, a sociology professor at Penn State University; the University of New Hampshire’s Carsey Institute; the Census Bureau; and the Population Reference Bureau.

Among the findings:

—For the first time since 1975, the number of white single-mother households living in poverty with children surpassed or equaled black ones in the past decade, spurred by job losses and faster rates of out-of-wedlock births among whites. White single-mother families in poverty stood at nearly 1.5 million in 2011, comparable to the number for blacks. Hispanic single-mother families in poverty trailed at 1.2 million.

—Since 2000, the poverty rate among working-class whites has grown faster than among working-class nonwhites, rising 3 percentage points to 11 percent as the recession took a bigger toll among lower-wage workers. Still, poverty among working-class nonwhites remains higher, at 23 percent.

—The share of children living in high-poverty neighborhoods — those with poverty rates of 30 percent or more — has increased to 1 in 10, putting them at higher risk of teenage pregnancy or dropping out of school. Non-Hispanic whites accounted for 17 percent of the child population in such neighborhoods, compared with 13 percent in 2000, even though the overall proportion of white children in the U.S. has been declining.

The share of black children in high-poverty neighborhoods dropped from 43 percent to 37 percent, while the share of Latino children went from 38 percent to 39 percent.

—Race disparities in health and education have narrowed generally since the 1960s. While residential segregation remains high, a typical black person now lives in a nonmajority black neighborhood for the first time. Previous studies have shown that wealth is a greater predictor of standardized test scores than race; the test-score gap between rich and low-income students is now nearly double the gap between blacks and whites.

___

Going back to the 1980s, never have whites been so pessimistic about their futures, according to the General Social Survey, a biannual survey conducted by NORC at the University of Chicago. Just 45 percent say their family will have a good chance of improving their economic position based on the way things are in America.

The divide is especially evident among those whites who self-identify as working class. Forty-nine percent say they think their children will do better than them, compared with 67 percent of nonwhites who consider themselves working class, even though the economic plight of minorities tends to be worse.

Although they are a shrinking group, working-class whites — defined as those lacking a college degree — remain the biggest demographic bloc of the working-age population. In 2012, Election Day exit polls conducted for the AP and the television networks showed working-class whites made up 36 percent of the electorate, even with a notable drop in white voter turnout.

Last November, Obama won the votes of just 36 percent of those noncollege whites, the worst performance of any Democratic nominee among that group since Republican Ronald Reagan’s 1984 landslide victory over Walter Mondale.

Some Democratic analysts have urged renewed efforts to bring working-class whites into the political fold, calling them a potential “decisive swing voter group” if minority and youth turnout level off in future elections. “In 2016 GOP messaging will be far more focused on expressing concern for ‘the middle class’ and ‘average Americans,'” Andrew Levison and Ruy Teixeira wrote recently in The New Republic.

“They don’t trust big government, but it doesn’t mean they want no government,” says Republican pollster Ed Goeas, who agrees that working-class whites will remain an important electoral group. His research found that many of them would support anti-poverty programs if focused broadly on job training and infrastructure investment. This past week, Obama pledged anew to help manufacturers bring jobs back to America and to create jobs in the energy sectors of wind, solar and natural gas.

“They feel that politicians are giving attention to other people and not them,” Goeas said.

___

AP Director of Polling Jennifer Agiesta, News Survey Specialist Dennis Junius and AP writer Debra McCown in Buchanan County, Va., contributed to this report.

___

Online:

Census Bureau: http://www.census.gov

The White Working Class: The Most Pessimistic Group in America

inShare

Eclipsed by demographics, new polling shows that this voting bloc feels increasingly alienated

Almost no one noticed, but around George W. Bush’s reelection in 2004, the nation crossed a demographic milestone.

From Revolutionary days through 2004, a majority of Americans fit two criteria. They were white. And they concluded their education before obtaining a four-year college degree. In the American mosaic, that vast white working class was the largest piece, from the yeoman farmer to the welder on the assembly line. Even as late as the 1990 census, whites without a college degree represented more than three-fifths of adults.

MORE FROM NATIONAL JOURNAL:

Paul Ryan’s Finest Hour?

PICTURES: Top 10 Monuments in D.C.

Palin to Launch Bus Tour

But as the country grew more diverse and better educated, the white working-class share of the adult population slipped to just under 50 percent in the Census Bureau’s 2005 American Community Survey. That number has since fallen below 48 percent.

The demographic eclipse of the white working class is likely an irreversible trend as the United States reconfigures itself yet again as a “world nation” reinvigorated by rising education levels and kaleidoscopic diversity. That emerging America will create opportunities (such as the links that our new immigrants will provide to emerging markets around the globe) and face challenges (including improving high school and college graduation rates for the minority young people who will provide tomorrow’s workforce).

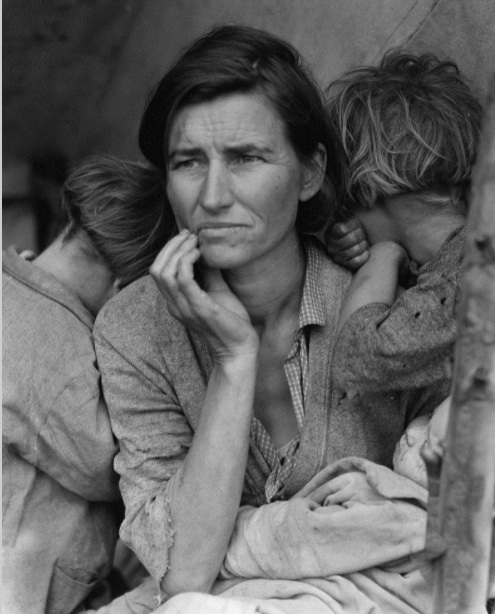

Waiting For The Food Shelf To Open – Homeless Sarah and husband Tom hope for a better Obama tomorrow – they’ve been waiting for five years.

Still, amid all of this change, whites without a four-year college degree remain the largest demographic bloc in the workforce. College-educated whites make up about one-fifth of the adult population, while minorities account for a little under one-third. The picture is changing, but whites who have not completed college remain the backbone of many, if not most, communities and workplaces across the country.

They are also, polls consistently tell us, the most pessimistic and alienated group in American society.

The latest measure of this discontent came in a thoughtful national survey on economic opportunity released last week by the Pew Charitable Trusts’ Economic Mobility Project. If numbers could scream, they would probably sound like the poll’s results among working-class whites.

One question asked respondents whether they expected to be better off economically in 10 years than they are today. Two-thirds of blacks and Hispanics said yes, as did 55 percent of college-educated whites; just 44 percent of noncollege whites agreed. Asked if they were better off than their parents were at the same age, about three-fifths of college-educated whites, African-Americans, and Hispanics said they were. But blue-collar whites divided narrowly, with 52 percent saying yes and a head-turning 43 percent saying no. (The survey, conducted from March 24 through 29, surveyed 2,000 adults and has a margin of error of ±3.4 percent.)

What makes these results especially striking is that minorities were as likely as blue-collar whites to report that they have been hurt by the recession. The actual unemployment rate is considerably higher among blacks and Hispanics than among blue-collar whites, much less college-educated whites.

Yet, minorities were more optimistic about the next generation than either group of whites, the survey found. In the most telling result, 63 percent of African-Americans and 54 percent of Hispanics said they expected their children to exceed their standard of living. Even college-educated whites are less optimistic (only about two-fifths agree). But the noncollege whites are the gloomiest: Just one-third of them think their kids will live better than they do; an equal number think their children won’t even match their living standard. No other group is nearly that negative.

This worry is hardly irrational. As Massachusetts Institute of Technology economists Frank Levy and Tom Kochan report in a new paper, the average high-school-educated, middle-aged man earns almost 10 percent less than his counterpart did in 1980. Minorities haven’t been exempt from that trend: In fact, high-school-educated minority men have experienced even slower wage growth than their white counterparts over the past two decades, calculates Larry Mishel, president of the liberal Economic Policy Institute.

But for minorities, that squeeze has been partially offset by the sense that possibilities closed to their parents are becoming available to them as discrimination wanes. “The distinction is, these blue-collar whites see opportunities for people like them shrinking, whereas the African-Americans [and Hispanics] feel there are a set of long-term opportunities that are opening to them that were previously closed on the basis of race or ethnicity,” said Mark Mellman, a Democratic pollster who helped conduct the Pew survey.

By contrast, although it is difficult to precisely quantify, the sense of being eclipsed demographically is almost certainly compounding the white working class’s fear of losing ground economically. That huge bloc of Americans increasingly feels itself left behind–and lacks faith that either government or business cares much about its plight. Under these pressures, noncollege whites are now experiencing rates of out-of-wedlock birth and single parenthood approaching the levels that triggered worries about the black family a generation ago. Alarm bells should be ringing now about the social and economic trends in the battered white working class and the piercing cry of distress rising from this latest survey.

Image credit: Nir Elias/Reuters

View Photo

View Photo

Source: Bureau of Labor Statistics, via Haver Analytics. The lines show worker flows from unemployment last month into each of the following statuses in the current month: unemployment, not in labor force, employment.

Source: Bureau of Labor Statistics, via Haver Analytics. The lines show worker flows from unemployment last month into each of the following statuses in the current month: unemployment, not in labor force, employment.